Buying or investing condotel is one way you can enjoy the hassle free ownership with luxury of living, instead of buying a condo. But before you invest in condotel you need to know first the Know How.

What is condotel?

Condotel is a combination of a condominium and a hotel. It is a condo with perks and other privileges similar with a hotel. Normally it is shared by investors or shareholders.

When you are intended to invest in condotel, learn the basic first. This is why I write this article for you so that you are aware of the basic things you must know.

Types of Condotel Ownership:

- Privately Owned Room – An investor owned the whole unit or room. He/she purchased the whole share. If one room has 13 board lots for 1M then the amount of investment would be 13M.

- Time Shared – A time shared or vacation ownership varies and changing over the decades of time. From the word itself, the sharing is based on time. For each ownership they shared based on allotted period of time. Meaning you buy a property to use it for a specific span of time. But they didn’t owned the property. They are using a point system.

- Fractional Ownership – Fractional ownership owns a share or part of the unit with privileges of using the property within a period of time which normally 30 days annually. Meaning multiple buyers will own one unit and owns equal part of the title. The investor have a stake in a property without the worries of paying the expenses such as maintenance and taxes. This is the ownership that I have now.

How to Earn in Condotel?

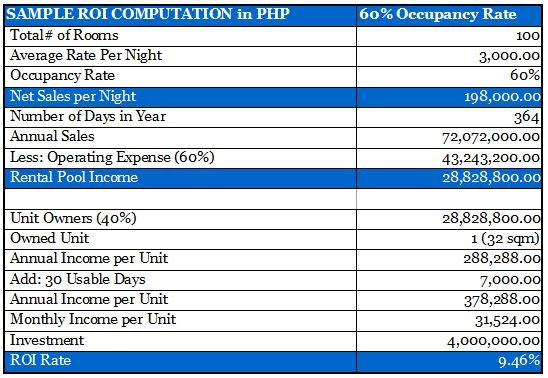

Investment on condotel usually earn based on occupancy rate. It is the number of rooms occupied for a specific period of time. If the condotel has 100 rooms and fully occupied for the month of December, then the occupancy rate is 100%. Normally, that month, is peak season in the Philippines this is based on Siglo data last year 2017.

Let’s have a sample computation of your earning. If the agreed term of earning your share is monthly, and you own as share of 25%, and the net income of the condotel is Php 375K less all the expenses, then you will be earning Php 93.8K a month.

Here’s a detailed computation. If you invest 4M with 9.46%, you will get your return on investment after 11 years, given that the occupancy rate is 60% consistent.

Related Article: How to Compute Condotel ROI

Benefits of Condotel:

- Passive Income – A condotel normally earns based on occupancy rate. Your passive income is based on the volume of occupied rooms for a certain period of time. Given the figures above for a 4M share, the return to you after 11 years is not bad.

- Capital Appreciation – Aside from the Passive Income, real estate is normally appreciating. Possibly after 11 years, your investment could be double plus your ROI or we could say your yield will be 200%.

- Free Use of the Unit – As an owner of condotel you will be having 30 days free stay using the amenities. The 30 days free depends on the developer.

- Hassle Free Ownership, no landlord issues, avoid maintenance, no headaches.

- Other Benefits:

-

-

- Accor Hotel Membership Privileges worldwide (if you choose Century Properties)

- 30 to 40 % Revenue

-

This is the primary reason, why I choose investing in Condotel rather than Condo units.

But I am planning to venture in Commercial Space Rental in the Future. According to my former professor who is a financial guru, the ROI percentage per year are higher than residential rental property.

Better Advice: If you are new to investment, please study and learn first. Because learning can give you a leap of faith in developing yourself and how to use money in a more positive and creative way.

Condotel is my second investment. Based on my assessment, I should use first my money in investing into business rather than into condotel. Once your business grow, and you have a lot of surplus, condotel would be the best for you. Having a condotel is a good way for an entrepreneur to relax and unwind and enjoy its luxurious lifestyle.

If you have any questions or queries, please comment below or email us at info@betterandfree.co.

Disclaimer: Century Properties is not linked to us nor a sponsor of this site.

![]()